Potential Returns: 💰💰💰💰💰 (5/5)

Risk Level: 🛡️🛡️🛡️⚪️⚪️ (3/5)

Complexity: 🧠🧠🧠🧠⚪️ (4/5)

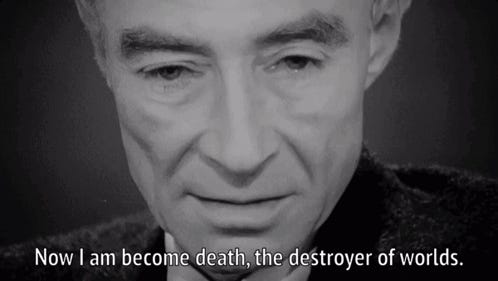

The Inspiration For This Portfolio:

The Fortress of Solitude is a portfolio of stocks that are steady growers in broad, low-risk industries.

The goal is to outperform the S&P500 significantly without putting in too much work.

The portfolio will always be updated here in case anything unexpected happens.

You can always find this post in the top menu and on the homepage in the “Indexes” section.

Lite Version of This Portfolio:

This portfolio contains 75 companies.

Let’s take a look at historical performance of my portfolio vs SPY 0.00%↑:

5-year performance (since 1.1.2019)

10-year Performance (since 1.1.2014)

This is all assuming we are buying the same amount of each stock.

The companies are categorized into 16 diverse sectors:

Consumer Electronics & Computing

Pharmaceuticals & Biotechnology

Luxury Goods

Consumer Staples & Household Products

Industrial Equipment & Machinery

Aerospace & Defense

Energy & Materials

Financial Services & Investment Management

Healthcare Services & Distribution

Construction & Building Materials

Chemicals & Specialty Materials

Waste Management & Environmental Services

Infrastructure & Energy Services

Semiconductor & Chip Manufacturing

Automotive & Transportation

Diversified Industrials

These are not just some random companies that performed well in the past.

They have extremely strong leadership, most are globally diversified, and are very likely to be around in 25 years.

No AI, VR, or Cryptocurrency bullshit in here.

We are focusing on companies that are ESSENTIAL to our society. Not social media, or another tech company that might not be around next year. I have chosen only 1 strictly tech non-essential company because of its cult status and following of its users.

No Google, no Nvidia, no Facebook, no Netflix, no Tesla, no Adobe, and no Disney. You catch my drift.

When shit hits the fan people will cancel their Netflix memberships, but they will still need a roof over their heads. That’s the idea of this portfolio.

I have spent countless hours analyzing each of these companies and have my own money invested in this index for several years.

Now, will this index do 500% in 10 years again? It might, but probably not. The goal here is to create a BETTER index than the S&P500 and I sincerely think I have managed to do that.

And you know what’s the funny thing? Most people have never heard of the majority of the companies that carry our society.

This is The Fortress of Solitude portfolio:

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.