⭐️ Masterclass: Stock Analysis — Viatris (VTRS),

A Low Hanging Fruit in the Pharmaceutical Industry?

To Smart Investors,

Jack’s note: Another amazing, free, non-sponsored Masterclass from my buddy Shailesh Kumar.

This is the first newsletter ever sent from my custom domain, https://thestockinsider.com!

Martin Shkreli, the poster boy for pharma greed, criticized this company at the rate it was raising its prices for EpiPen. On 2009 the wholesale price of two EpiPens was about $100, by July 2013 the price was about $265, in May 2015 it was around $461, and in May 2016 the price rose again to around $609, around a 500% jump from the price in 2009.

First, a little about me:

I’m Shailesh Kumar, and I write Astute Investor’s Calculus on Substack, where I dig deep into small-cap value stocks, constructing portfolios with the Kelly Criterion to offer long-term value investors the ultimate advantage—a trifecta of potential:

High-performing stocks strategically chosen in the top-performing asset class, small-cap value,

Precision-optimized allocations that seek to maximize your portfolio’s performance, and

A mathematically balanced approach that reduces volatility, so while stocks may fluctuate, your portfolio remains steady.

At Astute Investor’s Calculus I give you actionable ideas like this stock that has more cash on the books than its market cap and has no long-term debt. Think about it, someone can buy the whole company and reimburse themselves with the cash on the books, and end up with a profitable company for free!

Please note: I am not a financial advisor and this is not financial advice. You can lose money investing in something you do not understand so please do your own due diligence.

In 2018, Mylan was the largest generic pharma company in the world by revenue. It earned $11.26 B in global sales that year. Teva came in at #3 with $9.67 B in global sales. 3 years earlier, Teva had made an offer to buy Mylan for $40B but later dropped the bid. In 2020, Mylan combined with Pfizer’s Upjohn unit to become Viatris under a Reverse Morris Trust merger (Pfizer spun-off Upjohn, which was acquired by Mylan in a tax free transaction).

Viatris today owns some of the most recognized pharmaceutical brands such as Viagra, Celebrex, Xanax and of course EpiPen. It also has a vast generics portfolio. The controversies of the past are behind it.

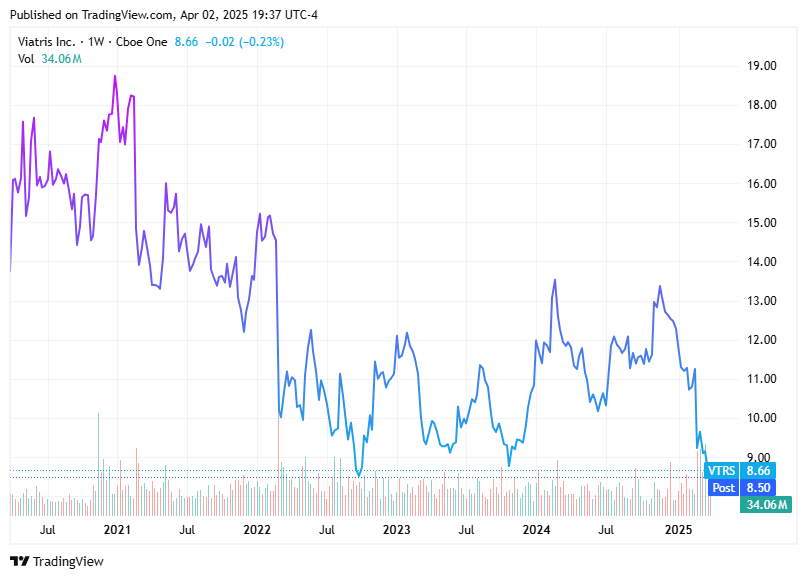

In 2024, the company had a revenue of $14.74 B. Today, the company’s market value is $10.34 B. The stock sells for

< 1x sales

3.95 Price/Forward Earnings

0.6 Price/Book

5.5% dividend yield

The stock has lost 27% in the last 1 year and about 38% in the last 5 years (since the merger). There are reasons for this stock price decline, and we will take a look at this in this analysis. I believe that the stock decline is overdone at this point and severely undervalues the company.

David Einhorn owns a boat-load of this company. In fact institutions own about 86% of the company. This is not the typical “undiscovered stock” I normally bring to my subscribers’ attention, but if my thesis is correct, this could be one of the lowest hanging fruit you can pick up in the market today.

Why has the Stock Underperformed Since the Merger?

Viatris began its life in 2020 with a dream portfolio of drug brands. You would think the company was set up for success. In fact, there were many predictions saying just that.

So what really happened?

There are 2 primary reasons:

Debt: Most transactions like this result in the spun-off company saddled with a large amount of debt. Pfizer received $12 B in cash infusion from this transaction which they used to pay down their own debt and focus on new drug development (think Covid in 2020). Viatris ended up with $25 B in net debt as it began its life.

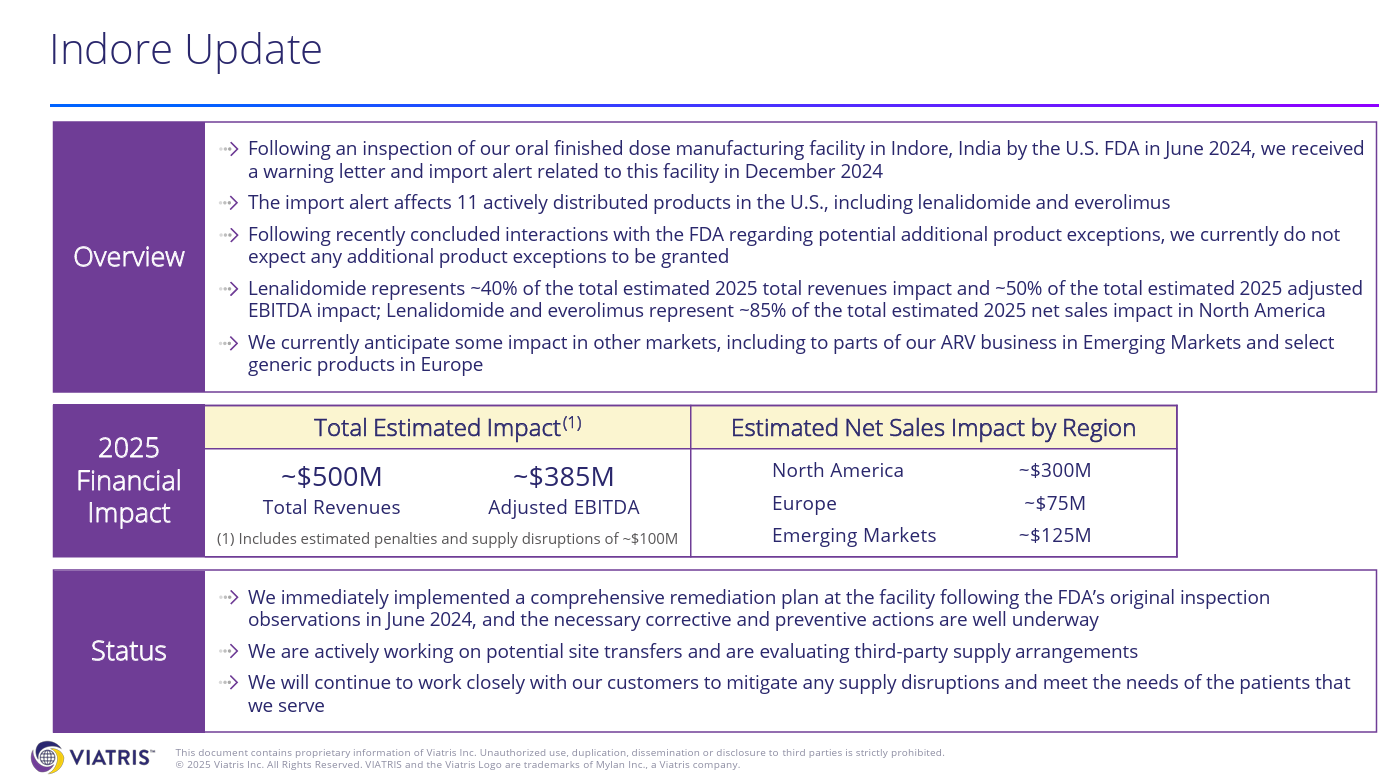

FDA Action: The company has run into a problem with FDA finding impurities in their plant in Indore India. The FDA issued a warning letter and an import alert to Viatris regarding its Indore facility in Dec 2024, following an inspection in June 2024. As a result, the FDA restricted imports of 11 actively distributed products manufactured at the Indore facility into the U.S. until the warning letter is lifted. Viatris estimates a significant negative impact on its 2025 financial results due to these regulatory actions. Specifically, they anticipate a reduction of approximately $500 million in total revenues and $385 million in adjusted EBITDA.

We will take a look at both of these reasons, judge how worried we should be, and then we will move on to consider their current financial position and future outlook.

FDA Action/Indore Facility Issues

The company estimates an adverse impact of about $500 million on revenues and $385 million in adjusted EBITDA in 2025.

It appears that this situation will be resolved fairly quickly and should not drag on to the next year. The company is well into the remediation implementation, past the 50% mark according to their Mar 11, 2025 update. They could be going back to the FDA for reinspection in the mid year 2025. There is an impact on the revenue and earnings in 2025, but this should also prove to be temporary.

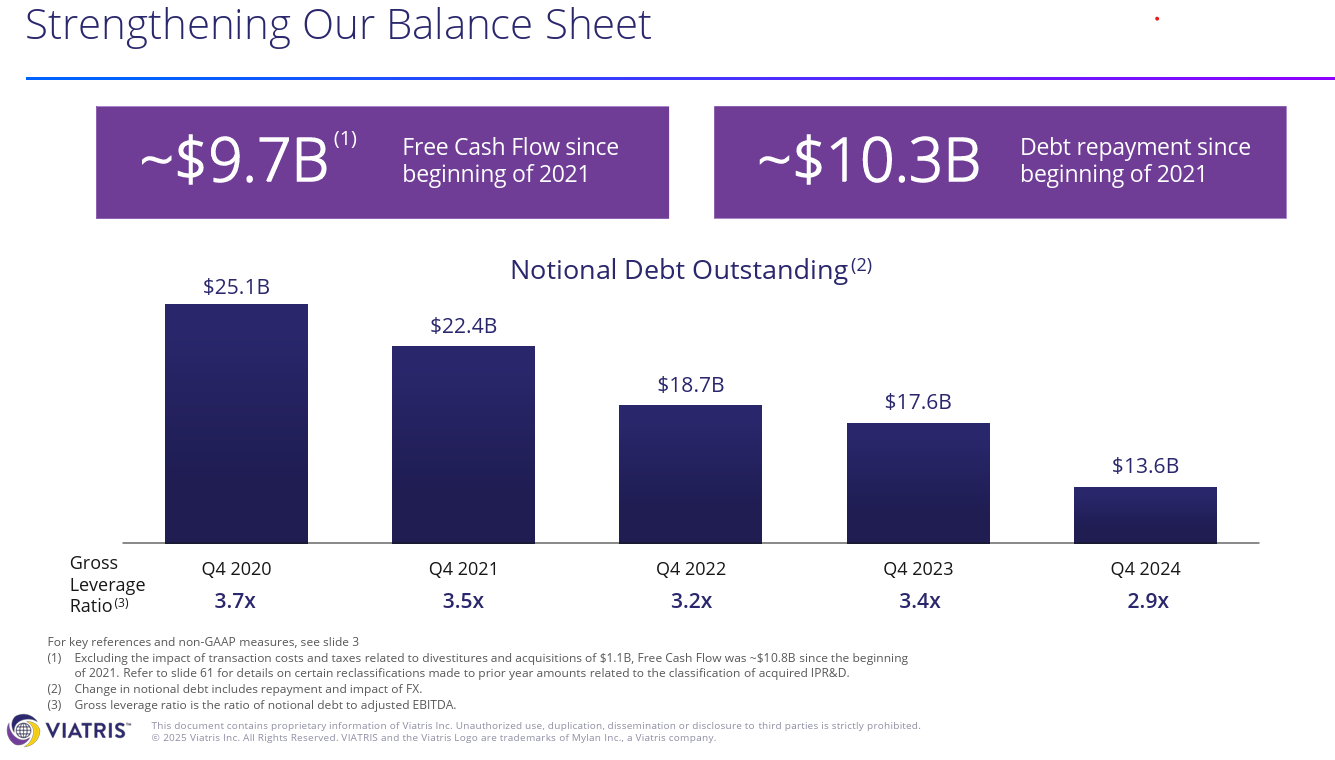

Debt Repayment

The company has been working on paying down their outstanding debt since 2021. The debt has declined from $25 Billion to $13.6 Billion and this has now brought the leverage ratio to a healthy range. A debt-to-EBITDA ratio between 2.5x and 3.5x is often considered a healthy range for pharmaceutical companies. Of course, a lower ratio is better but at this point the business is on the sound footing as far as debt is concerned.

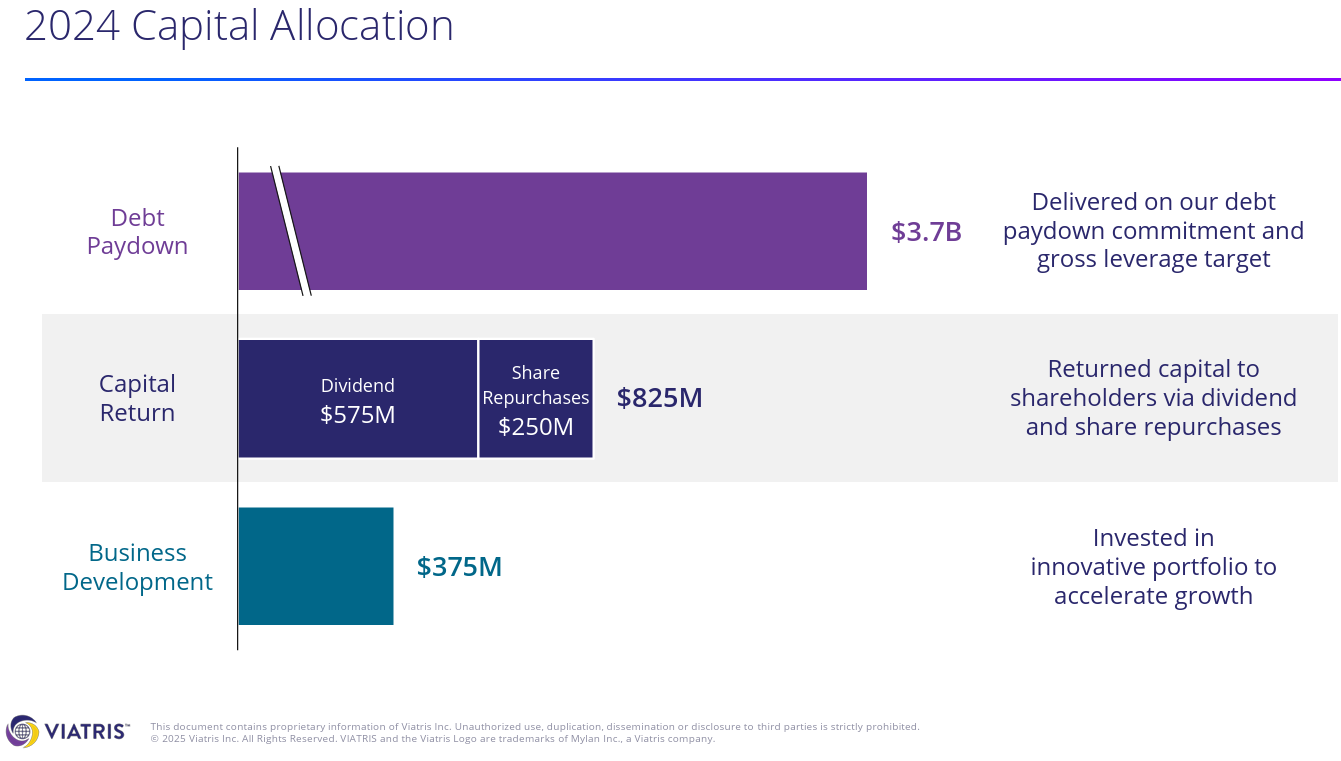

In 2024, the company utilized $4.9 Billion in free cash to pay down debt, return capital via dividends and stock buybacks, and reinvest in the business. Over 75% of the free cash was used for debt repayment. Part of the funding for debt repayments came from various divestitures (biosimilars, women’s health, etc) the company had done in the past 5 years.

For 2025, the company expects a free cash flow of around $2 Billion. They are prioritizing capital return with maintained dividend, and $500 million - $650 million in share repurchases. This is a step up from $250 m in share repurchases they did in 2024. At the current share price, a $500 million share repurchase will retire 5% of the shares outstanding.

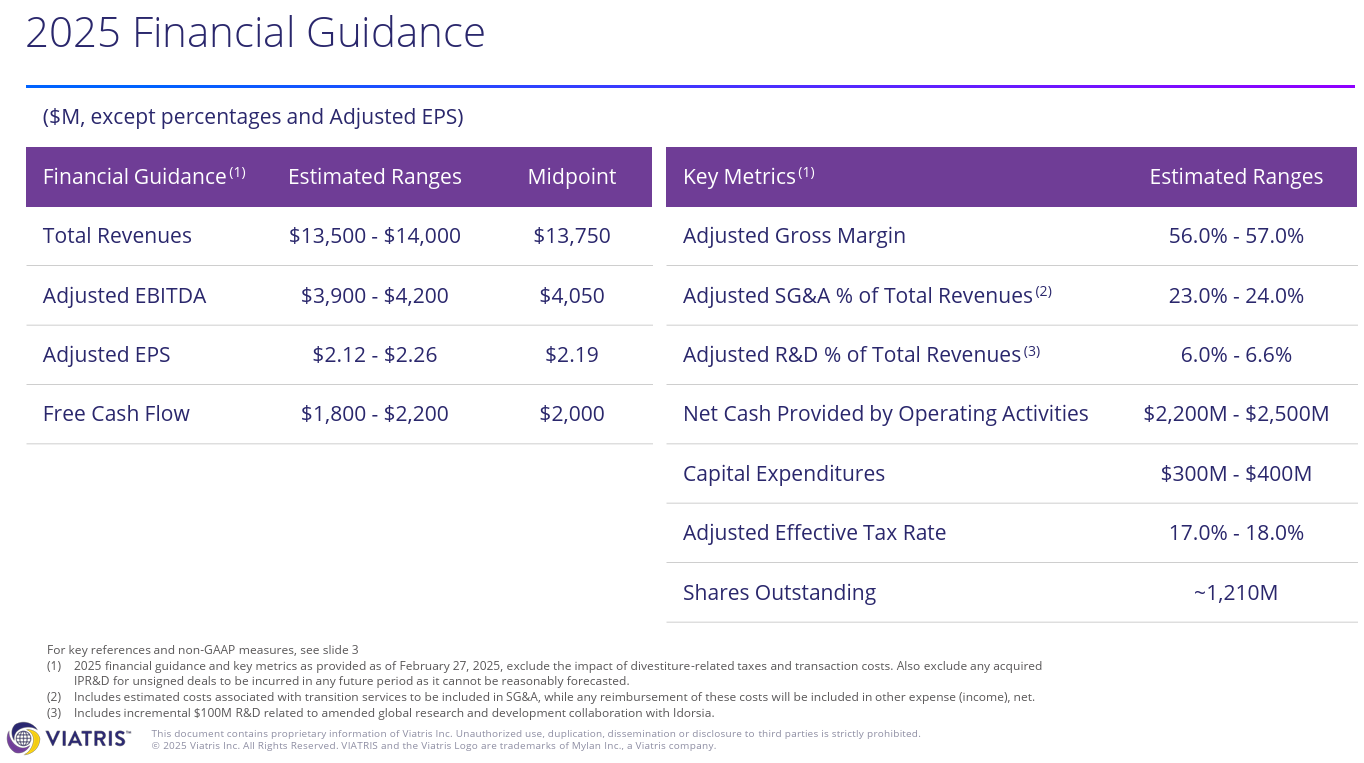

2025 Guidance

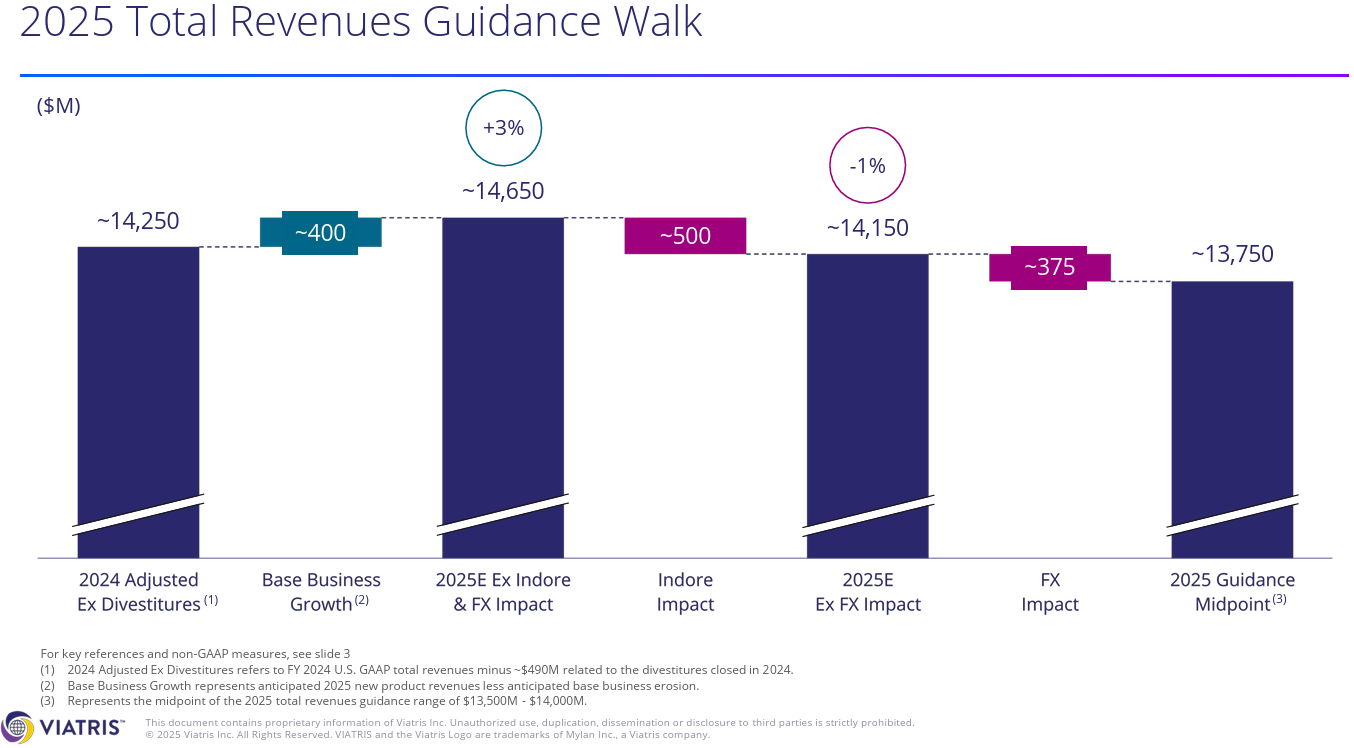

The guidance for 2025 is below the 2024 levels. The Indore issue is a big reason why. Foreign Exchange headwinds is another. The company does model a 3% base growth in revenue.

Without Indore, the guidance is for revenues slightly above 2024 levels.

Adjusted EPS will go from $2.5 (ex divestiture) to $2.19

Adjusted Gross Margin will go from 58% to ~56.5%

Free Cash Flow will go from $2.3B to $2.0B

At the current stock price of $8.66/share, this gives us a forward P/E ratio of 3.95, or an earnings yield of over 25%.

At the current market cap of $10.334B, the Free Cash Flow Yield is 19.35%. With the current short term treasuries yielding under 5%, this is a tremendous investment. Not to forget the 5.5% dividend yield.

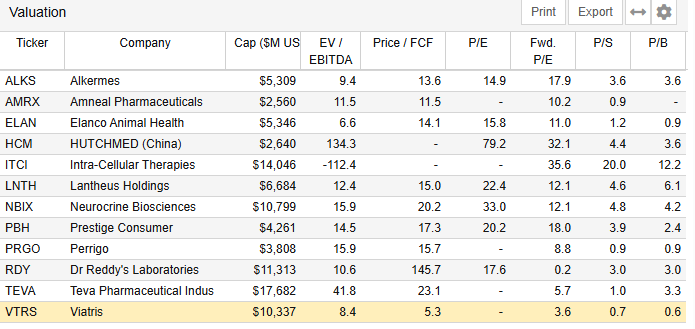

Undervalued by Peer Comparison

Peer comparison makes sense with similar companies in similar business cycle, and no company specific issues. In this case, we know that Viatris has Indore hanging over their head. We also know that the company is a recent spinoff/merger and therefore the balance sheet has not stabilized.

However, we have addressed these two aspects of the business.

Debt is now at a reasonable and stable levels, and,

Indore issue is being remediated and likely temporary. In the latest presentation at Barclays (Mar 11, 2025), the company stated that they are past the 50% mark for remediation and will likely go back to FDA for review mid year 2025.

We have also evaluated future projections that include the impact of Indore FDA Action. With this in mind, we can be comfortable with peer comparisons.

Teva and Perrigo are most similar to Viatris as far as generics are concerned. It also appears that the entire sector is currently being priced very conservatively. However, if VTRS were to reach similar valuations to Teva and Perrigo, we would be looking at about 50% increase in prices.

At 50% increase in prices,

The forward P/E ratio will be closer to 6

The P/B will be closer to 0.9, and,

The P/S will be a little over 1

Which are all in line with where Teva and Perrigo are currently trading. The company is not growing much so there is not much possibility of further multiple expansion. At this point, we are only looking for the valuation to be restored to the peer level.

This would take the stock price to $8.66*1.5 = $12.99/share.

Please note that the stock was trading at $13/share levels in 2024 before it took a hit due to FDA action. This adds further confidence in $13 to be a fair value for the stock once the impact due to the FDA action is fully managed.

It will still be a cheap stock at $13/share, and further improvement in debt profile and share buybacks and any future growth will push the stock price further up.

Bottomline

I like the stock at the current price of $8.66/share and expect it to be at $13/share or more by the end of 2025 for an upside of 50%+.

This will give it a market cap of $15.5 B, a far cry from $40 B Teva offered for Mylan in 2015, but we can be happy with a 50% upside potential in less than a year if the market agrees, and then possibly reevaluate if the business tangibly improves.

Please note: I am not a financial advisor and this is not financial advice. You can lose money investing in something you do not understand so please do your own due diligence.

Thank you Jack for the opportunity to guest post on your Substack!

You forgot to discuss the opioid situation and the degree of payoffs, bad publicity, and recovery times