Potential Returns: 💰💰💰💰💰 (5/5)

Risk Level: 🛡️🛡️⚪️⚪️⚪️ (2/5)

Complexity: ⚪️⚪️⚪️⚪️⚪️ (0/5)

Imagine having a portfolio that not only provides a steady stream of dividends but also has the potential for significant growth.

A strategy so robust that it weathers market downturns and thrives in bull markets—all while requiring minimal effort on your part.

Well, that's exactly what I'm about to share with you.

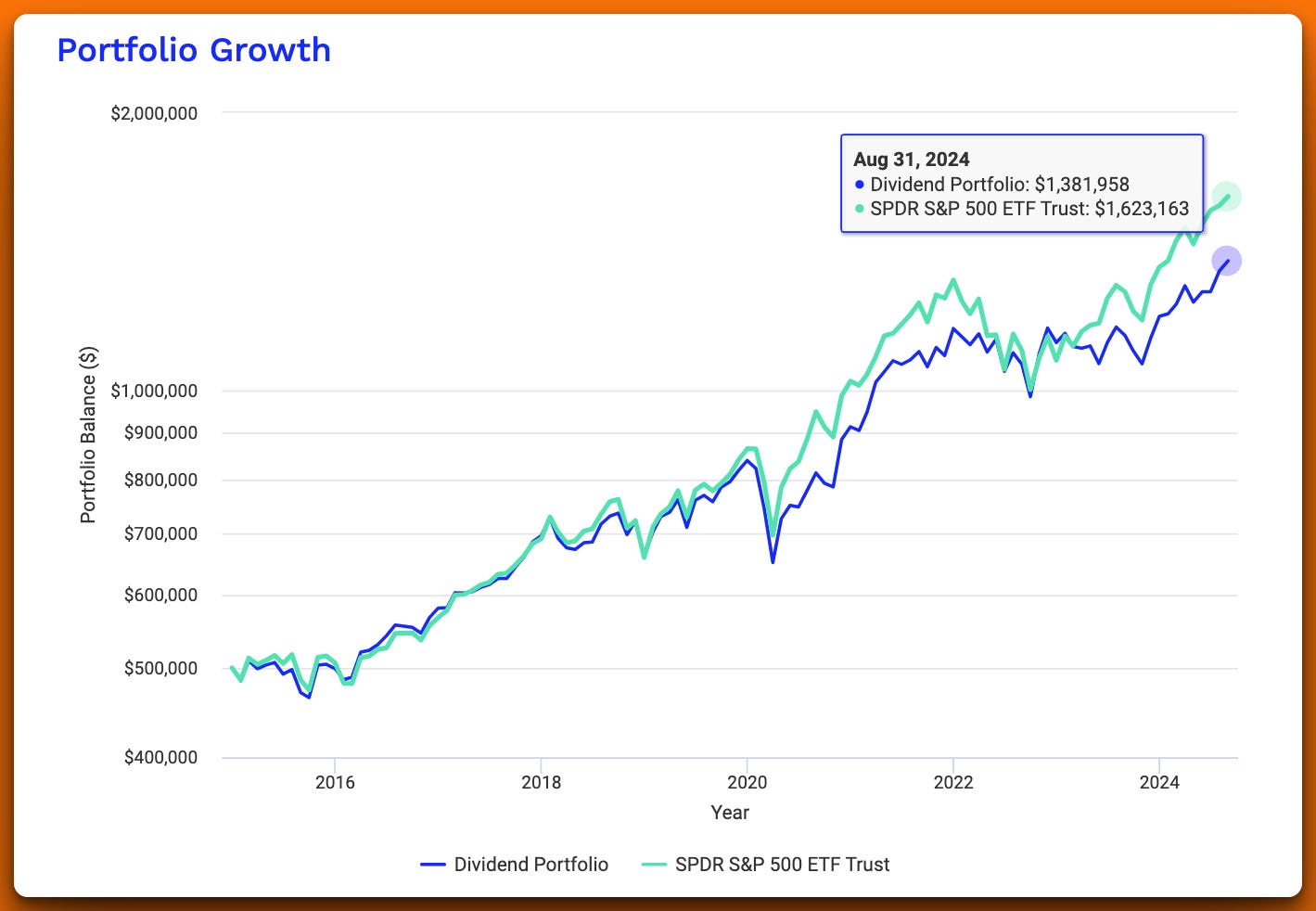

Take a look at the graph after 2022 to see how the portfolio performed during the COVID market recession.

It’s designed to be recession-proof while yielding dividends.

If a major depression would happen in the US, this portfolio would be much more beneficial compared to growth portfolios.

So for folks who are anticipating a depression, this portfolio or my Income Portfolio is something they should be looking into:

Dividend Yield Over 10 Years:

Why This Dividend Portfolio Stands Out

1. Steady Income Regardless of Market Conditions

In times of economic uncertainty, having a reliable income stream is invaluable. This portfolio is meticulously crafted to deliver consistent dividends, providing a financial cushion whether the market is soaring or dipping.

2. Balanced Growth Potential

While the primary focus is on income generation, this strategy doesn't sacrifice growth. It targets companies with strong fundamentals that are poised for long-term appreciation.

3. Diversification Across Sectors

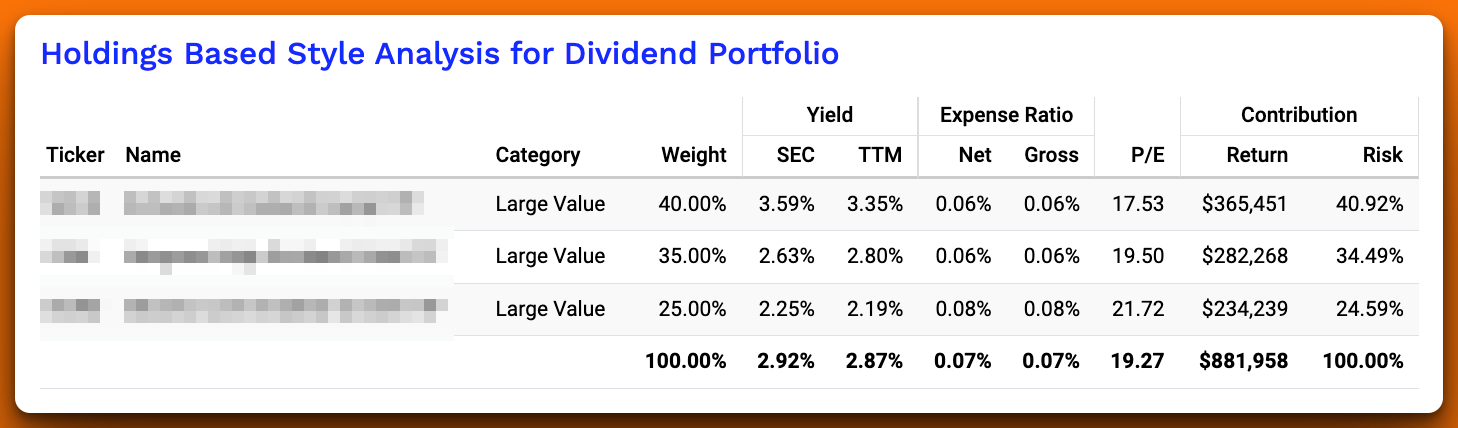

By investing in a select group of ETFs, we achieve broad exposure across various sectors—mitigating risk and enhancing potential returns.

4. Low Complexity

You don't need to be a financial guru to implement this strategy. It's straightforward, easy to manage, and doesn't require constant monitoring.

5. Building Multi-Generational Wealth

We are laying the foundation for generations to come. By harnessing the power of compounding and investing in quality dividend-paying ETFs, you're setting up a legacy of wealth that can benefit your children and grandchildren.

The Power of Dividend Investing

Dividend-paying stocks have long been a cornerstone for investors seeking both income and growth. Here's why:

Income Generation: Regular dividend payments provide a source of income, which can be reinvested or used to meet expenses.

Lower Volatility: Dividend stocks often exhibit less price volatility compared to non-dividend-paying stocks.

Compounding Returns: Reinvesting dividends can significantly enhance total returns over time.

Inflation Hedge: Dividends can increase over time, helping to protect purchasing power.

Legacy Building: A well-structured dividend portfolio can continue to generate income for future generations, creating a lasting family legacy.

A Glimpse Into the Portfolio's Performance

Over the past decade, the ETFs included in this portfolio have demonstrated impressive returns:

ETF X: Averaged 10% annual returns with a 3.5% dividend yield.

ETF Y: Delivered 9% annual returns and a 3% dividend yield.

ETF Z: Achieved 11.3% annual returns alongside a 2.3% dividend yield.

Imagine the compounded growth and income potential when these are combined into a cohesive strategy—not just for you, but for generations to come.

The Hidden Details Await You

I know you're eager to dive into the specifics—the exact ETFs, allocation percentages, and how to implement this strategy effectively. However, to maintain the exclusivity and integrity of this information, the full details are available only to my subscribed members.

Welcome to Your Path Toward Multi-Generational Wealth:

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.