⭐️ Week 15, 2025: Be fearful when others are greedy. Be greedy when others are fearful.

Few quotes provide as much insight into the mind of Warren Buffett as this one

To Smart Investors,

The Most Important Stuff:

Jack’s notes for this week:

This weekly report has 5,325 words. Let that sink in.

This week, I will publish an over 4,000-word piece in defense of the tariffs. Life is not black and white. I don’t write about politics—I write about the stock market—but I want America to succeed. I am not MAGA, and I’m not a Democrat. Cue the hate emails.

In response to some emails, I’m opposed to all insider trading by politicians, their families, and friends, including Nancy Pelosi. I believe that politicians should be banned from trading stocks or derivatives. If they aren’t making enough money, let’s increase their salaries. Simple. Again, this isn’t about politics but about a fair and transparent stock market.

My new website hub is up at https://www.thestockinsider.com/

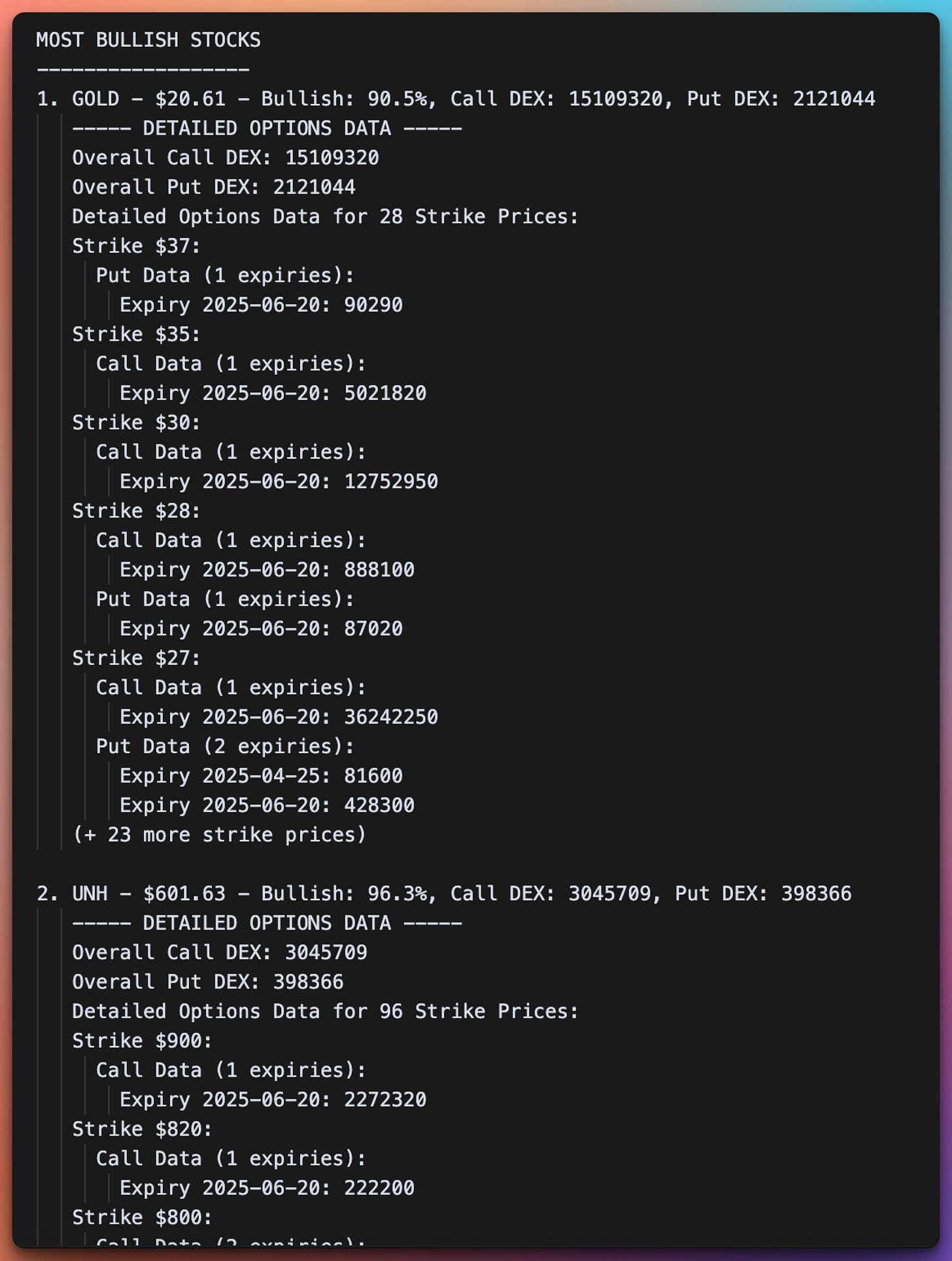

Stock Scanner sneak peek of the backend—we have ALL the institutional trades in one place:

We are polishing the front end to give you folks the most actionable information so that you don’t have to do the heavy lifting.

Coming this week once it’s 100% done.

Everyone will be notified by email.

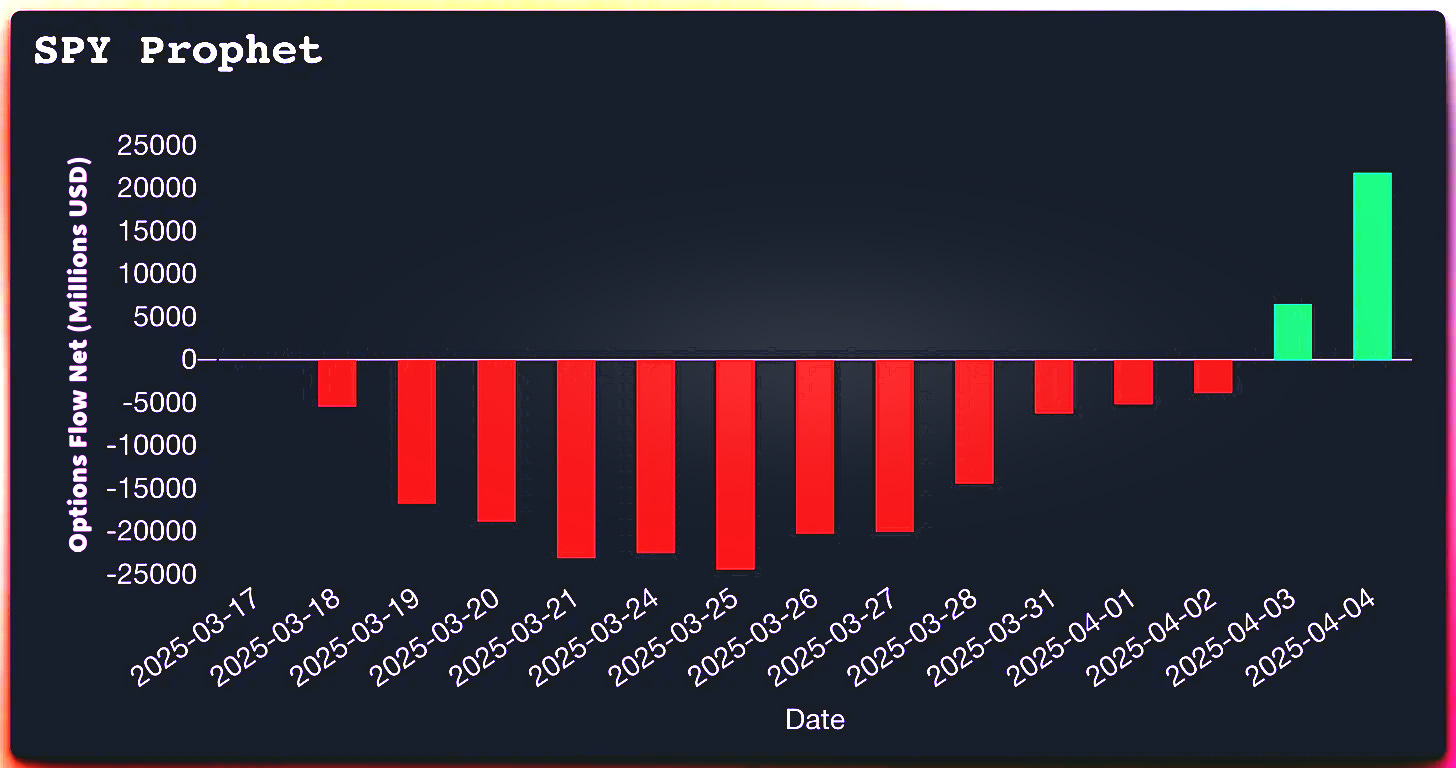

My Institutional Scanner predicted the market crash 2 weeks before it happened:

That is exactly what I was doing at Knight Capital Group.

Get grandfathered in while you can here:

As always, no discounts. The price only goes up as I release new tools and eBooks.

All prior memberships include 3 new SaaS tools (an options scanner, an undervalued stocks detector based on fundamentals, and another secret tool), 10 eBooks, and more. These will be released over the next 12 months. The books are already written and are being edited by a NY Times Best Seller editor.

THIS JUST IN: Not only you will get all of the above if you sign up in the next 48 hours, you will have access to the Business Tier of my Stock scanner that will be priced at $2.5k/month or more.

Listen to today’s free weekly Podcast here:

Stuff We Published Last Week:

As Always In The Sunday Report:

I have written a detailed recap of last week’s market, my predictions for next week, and an ELI5 (Explain Me Like I’m 5).

You can also find my typical quant data and the stock insiders’ significant buys/sells with my interpretation.

Every day, I post summaries of news relevant to Investors. I try to post about 30 minutes before the markets open and cover the last 24 hours of news. On the weekends, I post in the afternoon.

This daily newsletter is read by decision-makers at companies ranging from Berkshire Hathaway, Citadel, and BlackRock, Inc. employees to the oil traders in the Emirates and Saudi Arabia and back to Alphabet in Mountain View, California, Apple, and NVIDIA.

S&P500 Heatmap over the last week

This graph was generated by our friends at TradingView. Did you know you can get 60% off the Premium plan forever, even though it's not Black Friday?

SPY Overview

Our friends at TradingView generated these graphs. Did you know you can get 60% off the Premium plan forever, even though it's not Black Friday?

*Also, the chart above shows precisely why you need the Premium TradingView plan in your life. Plus, being able to monitor 8 graphs simultaneously while running complex indicators on them in parallel. Look into this:

SPY Recap & Outlook (April 7–11, 2025)

Below is a no-fluff, advanced rundown of SPY’s recent action in light of the latest tariff roller coaster, possible government insider trading, and key indicator signals.

1. Market-Moving Headlines

Tariff Chaos

President Trump’s 90-day tariff pause for most countries (excluding China) triggered whipsaw price action. Markets initially soared on Wednesday (S&P +9.5%) but then retraced as participants realized the suspension is temporary—and punitive tariffs on China remain at 145%.

China retaliated with its own 125% tariff rate on U.S. goods, effectively halting bilateral trade. This standoff hammered sentiment mid-week.

Possible Government Insider Trading

On April 9, suspiciously timed 0DTE options trades on SPY/QQQ yielded billions in minutes, allegedly leveraging non-public information about a tariff-pause announcement.

If proven, this scandal could spark heightened regulatory scrutiny—potentially hitting financials, large brokerages, and introducing fresh volatility.

Economic Data & Earnings

CPI and PPI surprisingly dipped for March, but inflation concerns remain high given new tariff pressures.

Big Banks (JPM, WFC, BLK) posted strong Q1 results despite the macro instability. The tone was cautious in guidance calls, citing potential slowdown if trade wars escalate further.

2. Price Action & Technical Levels

Support/Resistance

Key support sits near 520 (green line). A breach could unravel quickly toward 500.

Overhead resistance looms around 540–545, with heavier supply near 564—the next line in the sand for any bullish run.

Indicators

Macro Paradox (2–7 day lead, ~70–80% accuracy): Green line is rising, red line is drifting lower, hinting at near-term bullish momentum.

The Oracle: +4% over the last 10 trades, underscoring its ability to navigate chop.

MACD ≈ –14 and an ADX of 37 reflect recent trend volatility but don’t guarantee direction. The baseline read: the short-term bounce is alive but hardly bulletproof.

3. Week-by-Week Breakdown

April 7 (Mon)

Futures tank on new tariff announcements; S&P nearly enters bear territory.

Energy (–0.4%) and Tech (–1.4%) lead the downside as yields rise.

April 8 (Tue)

Dip-buyers emerge; treasury yields tick higher.

Mixed signals as the market grapples with conflicting trade rhetoric.

April 9 (Wed)

A wild session: insider-trading allegations coincide with Trump's surprise tariff pause for most nations.

The S&P 500’s +9.5% surge was the largest one-day gain in years—but overshadowed by the revelations of possible government leaks.

April 10 (Thu)

Stocks give back a big chunk of Wednesday’s rally. Realization sets in: China is excluded from the tariff pause, effectively freezing Sino-American trade.

April 11 (Fri)

Some stabilization after banks post decent earnings. Markets close the week with the S&P 500 up ~5.7% despite massive intraday swings.

4. Forward-Looking View

Short-Term

Macro Paradox suggests a mild bullish tilt next 2–7 sessions. Watch for 540 to see if upside can continue.

That said, the insider-trading scandal may amplify volatility. Heightened investigations often freeze liquidity, especially in derivatives markets.

Medium-Term

Ongoing tariff volley—particularly with China—remains a structural headwind. Any breakdown below 520 would confirm a return to risk-off.

Managing Pressure & Risk

With shareholders demanding progress, focus on capital preservation and tight stop-loss discipline around 520.

Keep an eye on volume spikes near big price levels; they could signal short-covering or forced liquidation due to potential regulatory crackdowns on insider activity.

5. Bottom Line

Despite last week’s face-ripping rallies and subsequent sell-offs, SPY remains in a fragile bullish posture. The Macro Paradox indicator is flashing short-term optimism, but the insider-trading saga and unresolved tariffs on China threaten to shatter risk appetite in a heartbeat.

Stay nimble, leverage reliable signals (like The Oracle), and remember: breaking below 520 means your shareholders won’t be the only ones raising hell.

Disclaimer: This analysis is purely educational and not financial advice. Always consider multiple factors and your own risk tolerance before making trading decisions.

*Macro Paradox is available for free here

Please send feedback and ideas using comments, PMs, or email. I answer all emails and PMs personally. There is no personal assistant BS here.

And, as always—stay informed—and do your own due diligence.

With every good wish, I remain

Yours sincerely in Christ,

Jack Roshi

Applied Mathematics Department, MIT

Lead Quant and Board Member, Alpha LLPOpinions are my own

Executive Summary of Last Week:

Period: April 7–11, 2025

The markets have been riding a rollercoaster amid escalating tariff warfare, sharp swings in fixed-income yields, and a deepening government insider trading controversy. On April 9, coordinated trading—allegedly using 0DTE options on SPY and QQQ just before President Trump’s tariff-pause announcement—has raised serious questions about market integrity and potential regulatory intervention. Despite intermittent rallies fueled by sudden policy shifts, the underlying data reveals brutal volatility:

Tariff Tensions: The Trump administration’s brutal tariff schedule—ranging from a baseline 10% to as high as 145% on Chinese imports—coupled with retaliatory moves from China (up to 125%), has shaken investor confidence.

Market Volatility: Futures and equities have swung wildly. The Nasdaq and S&P 500 recorded intraday surges and dramatic pullbacks, while Treasury yields have both spiked and dropped sharply over the week.

Sector Shifts & Earnings: Tech titans and financial powerhouses (e.g., JPMorgan, BlackRock) posted mixed earnings against a backdrop of titanic moves in Tesla, Apple, and Nvidia. The week’s trading painted a picture of an overextended market—periods of relief following aggressive policy adjustments were soon replaced by renewed caution.

Macro Signals: Despite a near-term easing in CPI and core inflation, consumer sentiment and forward inflation expectations remain highly unstable, cautioning that the market’s relief rallies may mask deeper economic uncertainty.

For a comprehensive day-by-day analysis of these events—including detailed market data, corporate earnings insights, and regulatory implications—please refer to the in-depth examination below (paid subscriber content).

Please subscribe to my Substack to access the premium report, which includes a comprehensive day‐by‐day breakdown, in‐depth weekly analysis, a list of the most shorted stocks, Excel spreadsheets of options flow, the most active stocks, projections for the next week, and insider trades and their interpretation.

Detailed Day-by-Day Analysis:

Keep reading with a 7-day free trial

Subscribe to The Stock Insider to keep reading this post and get 7 days of free access to the full post archives.